One of the most popularly known recharge site “Freecharge” which offers you to Recharge your Prepaid/Postpaid/Dth and many other things just under 10 Seconds as well as credit Your Cashbacks instantly in your Freecharge Account has now come up with its New Light Fastening Feature which is that now you can transfer your Freecharge Credits to your Bank Account Instantly. The best part is that Freecharge doesn’t take any Extra Charges to Transfer Money to your Bank Account.

How to Transfer Freecharge Credits to Bank Account ?

1. Visit Freecharge.in

2. Login to your Account

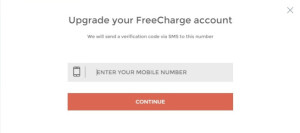

3. Now you have to Upgrade your Freecharge Account by Linking it to your Mobile Number

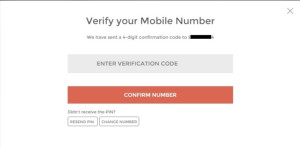

4. Enter Verification Code which you have Received via SMS

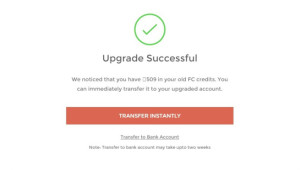

5. After Verification Click on “Transfer Instantly” to transfer your Credits to your all New Upgraded Freecharge account

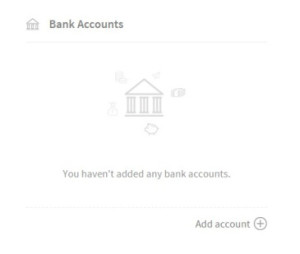

6. Now, Visit Freecharge Account Section

7. You will See “BANK ACCOUNT” Section in the Right Side. Click on “Add Account”

8. Enter your Account Details like – Account Number, Bank Name, IFSC code and your short name and Click on SAVE

Now you are Ready to Transfer your Freecharge Credits to your Bank Account

9. After doing all the above mentioned steps, Visit Freecharge Cash Option

10. Click on “Withdraw Money to Bank” Option

11. Enter the Amount which you have to Transfer and Click on “Generate Password”

12. Now Enter the OTP which you have received via SMS or Email

That’s it !! Your Freecharge Credits will be Transferred to your Bank Account. You will Receive the Money credited SMS from your Bank Soon

Freecharge has introduced two different balance system i.e General Balance and Voucher Balance. Only General Balance can be transferred to Bank whereas Voucher Balance which you get through cashbacks cannot be transferred

Terms & Conditions

1. Money that was added less than 24 hours ago cannot be withdrawn for security reasons

2. Promotional cash given out by merchants cannot be withdrawn to bank

3. You can transfer a maximum of Rs. 5,000 to your bank account in a single transaction. In addition, the limit on withdrawal to your account per month is Rs. 25,000